“At some point, everything’s gonna go south on you. And you say to yourself, ‘This is it. This is how I end.’ Now you can either accept that or you can get to work. That’s all it is.

You just begin. You do the math. You solve one problem. Then you solve the next. And if you solve enough problems, you get to come home.” – The Martian

**************

“Just close it down,” said my Dad, in no uncertain terms.

In the first quarter of 2015, my startup was dead in the water. We only had 3 months left of cash in the bank.

My father knew how to cut his losses. A serial entrepreneur, he’s tried many businesses over the years. And he wasn’t afraid to pull the plug when things weren’t going as planned.

Some context is in order. In the 2nd half of 2012, I raised a seed round of a few hundred thousand dollars. The objective was to grow a Gilt-style flash sales site. At that point, the startup was doing seven-digit revenues with profitable unit economics. It took about 6 months – fundraising in the Philippines is like our internet speed, slow AF – but it was easy to do. Valuation math is a breeze when you can divide percentages in your head.

But I made the mistake of listening to early advice to be lean, raise less now, and go for a bigger round in a year or two. I knew empirically that e-commerce – especially in infrastructure-void Philippines – needed immense scale. And scale required capital upfront.

That’s the first lesson of fundraising: never listen to advice that asks you to raise less than what you need. You know your business best, and investors have an incentive to doll out this advice – to cut your valuation, conserve their checkbook, etc.

Armed with our little funds, we adapted to the ruthless Darwinism of the free market: focusing on Metro Manila, building a brand, targeting the premium segment of the market that wasn’t price-sensitive (credit cards were 80% of our transactions, a rare outcome in this country), and hired 20 people. As a result, we grew gross revenue 6x in 2013.

Then the world changed. The flash sales model soon fizzled out as inventory ran dry. Though we had enough funds to cover overhead and customer acquisition, running lean meant we didn’t have enough to invest in inventory, R&D, logistics, and warehousing.

Merchandise revenue, which I forecasted to double in 2014, contracted by 10%. Normally, this wouldn’t be a disaster. But in e-commerce, growth is everything.

By the time 2015 hit, we had to move out of our office because we couldn’t afford the rent. I slashed my salary by 60% to make sure our employees made 100% of theirs. The COO I hired to help professionalize the business turned out to be a poor fit. Our CTO, who’s been with us from the start, had left. Morale sank.

I can’t say I wasn’t tempted to abandon the sinking ship. I had lots of other startup ideas. There’s been standing job invitations from a telco and a private equity firm, not to mention the constant inbound recruiting emails from Rocket Internet and Uber. I said no to all of them.

And as impossible as this situation sounds, it’s actually nothing out of the ordinary. 80% of startups fail within 3 years.

It was one of our customers that helped us out of the slump. It turns out that Kim Jones, before she became the huge brand ambassador she is today, was a customer. She loved our products, and one conversation led to another. In the middle of 2015, we launched her private label collection.

Remember that story about Airbnb’s founders selling cereal to make ends meet? Well, we did something similar too. It turns out our team was one of the few in town who actually had experience in building an end-to-end e-commerce platform from scratch. IT dev shops only knew the tech. Ad agencies only knew the marketing. We did everything. Our business experience allowed us to charge a premium. So a small side project for a brand turned into a multi-million deal that essentially saved the company. We were the cereal.

The rest of 2015 turned out to be a tumultuous year. There was acquisition talk with a prospective buyer, but we couldn’t agree on the price. A huge foreign e-commerce company offered a term sheet to lead a series-A, but freaked out when they faced massive foreign ownership restrictions in mass media and retail. The founder wanted to take his private jet and fly here to Manila, but was advised by his security team not to. Besides, that pretty young starlet he was dating kept him busy. Then, our original investor invested in the competition instead. Another local angel wanted to invest, but I no longer wanted to take capital if it was in small amounts.

All this was a distraction: each had no meaningful contribution to the goal of building a business.

As we entered 2016, there was only one move left to make: make the venture cash-flow positive. It was time to take our destiny into our own hands.

We launched another site, cut non-performing staff, and built an enterprise business doing digital strategy, e-commerce, and content, with local and international partners. By the end of 2016, our business turned cash flow positive after 2 consecutive years of steady growth. By 2017, we had more cash in the bank than when we started.

Meanwhile, it was a bloodbath in the local e-commerce market, as several local sites collapsed, among them well-funded international players. Only the biggest, most-capitalized foreign players, or well-run local sites remained.

There was immense joy in finding a win in a no-win situation. You will never have an experience as meaningful and gratifying as facing the brink of the abyss and coming out alive, middle finger raised to the air.

And when word quietly got around that we were one of the few profitable ventures in town, we started getting inbound emails from random investors, including some who had rejected us before. Some clients offered to invest. I politely declined all of them.

This story is relevant because in a recent survey, 94% of PH startups see themselves raising funding in the next three years. Most will fail.

They’ll all go through the same journey we did, more or less. The excitement of a small group of friends wanting to conquer the world. The euphoria of winning a pitching competition and attracting media attention. Launching product. Getting your first few customers. And the brutal counterpunch of reality. Just another day in startup land.

The startup scene in the Philippines is like masturbation – lots of fantasizing, ego-stroking, and wish fulfillment, but not much real action going on.

Founders will read Techcrunch and Tech-in-Asia, join pitching competitions, attend conferences, and regale at the stories and startup advice of this month’s speaker – who by the way is either a government buffoon or is someone who has never built a business with his/her own capital before.

All this only increases the gap between wishful thinking and reality.

The stark reality is that if one looks at a map of Southeast Asia, you’ll see that the Philippines sits apart. It has the smallest venture capital market (in # of deals and value). It’s overlooked by the much bigger regional funds in favor of Singapore and Indonesia. There are very few really good angels, and a lot of predatory ones.

There’s been a number of initiatives over the years to change that, but none have really worked, thanks to the combination of a protectionist Constitution, our underdeveloped capital markets, and the complex regulatory environment (all topics worthy of exploration in a separate article). Just look at our foreign investment metrics as proof. Even Vietnam is eating our lunch.

Thus, scarcity drives the local startup game. And that’s the big point of this post if you’ve made it this far: because the game is stacked against founders, to raise startup funding in the Philippines, you have to make investors believe you don’t need the funding.

And the most empirical way to demonstrate this is to build a cash-flow positive venture. That’s all there is to it. Don’t repeat our mistake in delaying cash-flow positive status to after your 2nd or 3rd funding round.

Because of the smaller early stage funding market relative to Singapore or Indonesia, I would argue that new local Filipino founders should:

1. Have a bias for picking ideas that can be funded by customers, rather than investors

2. Draw a solid plan to get to cash-flow positive ideally in the first year. Maybe two years – max.

3. Have a low enough cost base that can be funded by 1-2 clients if you’re B2B, or 100 customers if you’re B2C. Forget about it if you’re advertising-dependent (Facebook & Google have won).

4. If you do need to raise funding, treat it as a last resort, and give yourself a hard deadline, say, 6 months.

5. Start with regional investors rather than local ones.

6. Incorporate in Singapore, Hong Kong, or Delaware. Create a local operating subsidiary only if necessary.

This certainly narrows the space for the kind of startups the Philippines can build. But it’s not impossible. An enterprise-focused SaaS product with a strong consulting arm can certainly be cash flow positive within a year. Or a direct-to-consumer online store with only 100 monthly customers but PHP 5,000 ATV and low overhead can certainly be profitable.

“That all sounds good, Oliver,” you might say, “but aren’t startups all about growth? What about those ideas that need massive growth and scale to be profitable?”

Sure, I’m not discounting the possibility of success for such models. But the Philippines is not the place to start capital-intensive startups. You’ll need to be based in Singapore or Jakarta to access the capital needed to fund hyper growth, and simply have the Philippines as another portfolio country.

Which brings us now to an honest discussion about access to capital.

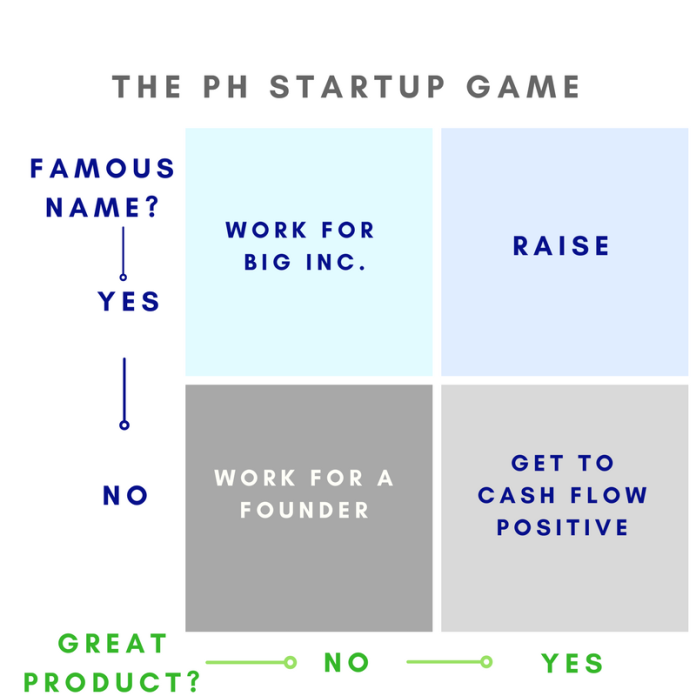

If you’re just starting out or if you’re cash-flow negative, you then need to figure out where you are in the local Startup Game.

The Game is defined by this 2×2 matrix. This matrix applies if you:

1. Want to do or are currently doing a startup

2. Have a reasonable amount of self-awareness

3. Have objective metrics on the viability of your product

Note that this matrix describes your starting point, not your end-state. It helps define your initial moves, not your destiny.

On the X-axis is your product. Does it have product-market fit, based on objective metrics – users, revenue, margins, retention, net promoter scores, etc?

Now, the Y-axis will likely sound controversial, but it’s the honest truth. On the Y-axis is a famous name: your family name, your school’s, or a previous company affiliation.

It doesn’t mean that raising is an impossibility, but your product will just have to be way better compared to someone in say, Singapore. When I was raising our first round, I got a lot of advice to mention my school or the fact that we won the Asia Pacific leg of the Harvard New Venture Competition – never mind that neither was a factor in our odds of success! But people are herd animals, and you would be wise to take advantage of this gap in human psychology.

If you have a great product and a famous name, go ahead and raise. Do one round and get to cash-flow positive.

If you have a great product, without a famous name, I’d argue not to waste your time fundraising. Instead, you need to get cash-flow positive ASAP. Keep a good SEO strategy for your startup’s name and a healthy LinkedIn presence, and wait for the inbound investor requests to trickle in. You get investors to pitch you rather than the other way around.

If you don’t have a great product, but have a famous name, your next moves will depend on the nature of your famous name. If it’s your school or company, then you might be better off working for Rocket Internet or Uber for 1-2 years to learn the ropes. These guys love brand name degrees. Pick the role wisely. If you want to be an entrepreneur one day, working as a Product Manager at Grab is superior to a sales job at Google.

If it’s a famous family name that you have but not a great product, you can likely syndicate together 1-2 years worth of runway. Manila is full mediocre businesses from children of tycoons and suckers posing as investors.

If you neither have have a great product nor a famous name, you have three options:

1. Learn how to build a great product on your own

2. Get a famous name by joining an awesome founder

3. Or my recommended option – do both of the above. This is best accomplished by working directly under a startup founder or the local GM of a global tech company. For example, the direct reports of guys like Ron Hose, Ravi Agarwal, Jerome Uy, Paul Rivera, Nix Nolledo, Laurence Cua, Ken Lingan, or John Rubio will likely have great careers ahead.

That’s essentially the game. You need to recognize where you are to determine the right moves to make.

If you decide to take the fundraising route, stay tuned for Part 2 of this post, where I’ll talk about some of the tools you’ll need.